change in net working capital meaning

Therefore working capital will increase. Define Changes in Net Working Capital.

Working Capital Formula And Calculation Exercise Excel Template

In this case the change is positive or the current working capital is more than the last year.

. However if the change in NWC is negative the business model of the company might require. Since the change in working capital is positive you add it back to Free Cash Flow. So this increase is basically cash outflow for the company.

Means Net Working Capital at the end of the Performance Period less Net Working Capital at the beginning of the Performance Period. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future. A net working capital analysis is one of the key areas in financial due diligence in addition to a quality of earnings analysisie adjusted EBITDA earnings before interest taxes depreciation and amortizationand a debt and debt-like items analysis.

If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities. Be sure to include depreciation in the operating income calculaton though. Lets use MarketXLS to calculate working capital of Apple Inc.

You will still need additions to net working capital in the terminal year so it should be included or removed in the calculation of cash flow in the terminal year. Also any existing Capital One accounts must be in good standing meaning not over limit past due or delinquent. For the year 2019 the net working capital was 7000 15000 Less 8000.

Trade Words Read related entries on C International Trade Dictionary CH Import Export Terms International Trade Definition. Define Change in Net Working Capital. Examples of Changes in Working Capital.

And to do that we will have that year number in one column and we will simply refer to that column when calculating the current assets and the current liabilities. Changes in the Net Working Capital Formula. Because of this NOWC is often used to calculate free cash flow.

Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. A change in working capital is the difference in the net working capital amount from one accounting period to the next. If the change in NWC is positive the company collects and holds onto cash earlier.

Means changes in accounts receivable adjusted for non-cash items plus changes in inventory adjusted for long-term and non-cash items less changes in accounts payable adjusted for royalties and rebates. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Instead of using the current assets and the current liabilities functions you can also use the.

Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. Positive working capital is when a company has more current assets than current liabilities meaning that the company can fully cover its short-term liabilities as they come due in the next 12 months. It means that the company has spent money to purchase those assets.

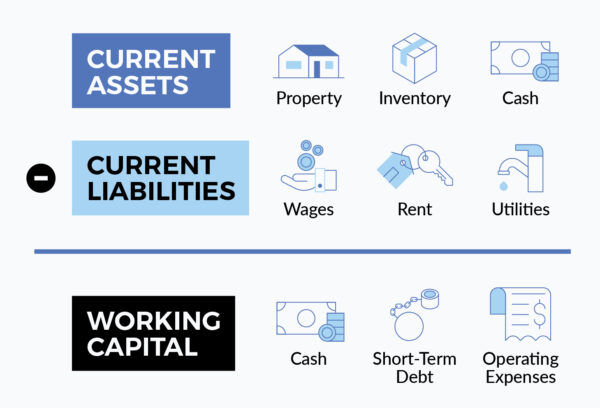

It consists of the sum of all current assets and current liabilities. Therefore Microsofts TTM owner earnings come out to be. So current assets have increased.

Changes in the Net Working Capital Change in Current Assets Change in the Current Liabilities. Net working capital NWC is current assets minus current liabilities. Lets understand how to calculate the Changes in the Net Working Capital with the help of an example.

Net working capital is also known simply as working capital. This metric is much more tied to cash flows than the net working capital calculation is because NWC includes all current assets and current liabilities. Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities.

18819105991263-13102 19192 34245. Net working capital which is also known as working capital is defined as a companys current assets minus itscurrent liabilities. From 2011 to 2016.

Lets look at an example. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. Change In Net Working Capital Author.

For year 2020 the net working capital is 10000 20000 Less 10000. Working capital also known as net working capital NWC is the difference between a companys current assetssuch as cash accounts receivablecustomers unpaid bills and. Net working capital is defined as current assets minus current liabilities.

A change in working capital is the difference in the net working capital amount from one accounting period to the next. You are right DA and capital expenditures will zero out or capex will be slightly higher than depreciation. Net working capital measures the short-term liquidity of a business and can also indicate the ability of company management to utilize assets efficiently.

Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses. Change in Net Working Capital Formula Example 2. Many people use net working capital as a financial metric to measure the cash and operating liquidity position of a business.

Changes in the Net Working Capital Net Working Capital of the Current Year Net Working Capital of the Previous Year. Now changes in net working capital are 3000 10000 Less 7000. Net Working Capital as of a specified date means the Companys trade accounts receivables plus inventories less accounts payables as those amounts are reflected in the Companys consolidated audited.

Change In Net Working Capital Nwc Formula And Calculator New product or market development etc. What is net working capital. Its a calculation that measures a businesss short-term liquidity and operational efficiency.

It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in. Its also important for predicting cash flow and debt requirements. Net working capital is the aggregate amount of all current assets and current liabilities.

Each of these analyses may have a potential positive or negative dollar impact to the.

What Is Working Capital Bdc Ca

Types Of Working Capital Gross Net Temporary Permanent Efm

Working Capital Formula And Calculation Exercise Excel Template

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Formula And Calculation Exercise Excel Template

Net Working Capital What It Is How To Calculate It

Changes In Net Working Capital All You Need To Know

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Formula And Calculation Exercise Excel Template

Importance Of Working Capital Management Accounting Education Financial Analysis Financial Strategies